Money seems to go fly away these days faster than the speed of light. Remember when the ‘dollar store’ actually sold things for a dollar? And you could legitimately include limes in a $29 grocery purchase? (Sorry Gwyneth). It’s tough to make a living, to raise a family and to teach your kids about money. But it is even harder to explain the mysterious disappearance of hard-earned money. Many Canadians have fallen victim to electronic pickpocketing, skimming or huge retail data breaches that have seen bank accounts dwindle and necessitated thousands of hours of time invested in cleaning up the mess left by criminals.

I was always a traditional money girl, starting with a piggy bank and bank book followed by my first debit card. It’s PIN (cough) may still be the same. Afterwards came the ‘student’ credit card at university with the bonus of a bunch of free tupperware. Like all people, I have forgotten my wallet on top of phone booths (remember those?) and let my credit cards disappear into restaurant kitchens for a shade too long. As life got busier, I admit that I was not always the best (double cough) at checking statements or bank balances. Times may have changed with the inventions of the internet, chip and PIN technology and e-billing, but wouldn’t it be great if there were a superhero protecting us from fraud? There is. Now Interac has made our earnings even more safe.

Bank-issued Interac debit cards with chip technology (the ones that give you access to your millions stashed in your bank accounts) are now more secure than ever thanks to comprehensive fraud prevention tactics and the new introduction of Interac Flash. Unfortunately, I’m not talking about the Avengers, though I do think Interac should be given a place in the superhero hall of fame.

Bank-issued Interac debit cards with chip technology (the ones that give you access to your millions stashed in your bank accounts) are now more secure than ever thanks to comprehensive fraud prevention tactics and the new introduction of Interac Flash. Unfortunately, I’m not talking about the Avengers, though I do think Interac should be given a place in the superhero hall of fame.

“Interac Flash, the contactless payment functionality of Interac Debit, has all the benefits of Interac Debit but it allows you to pay for smaller purchases faster and easier. When making a purchase for less than $100, you can choose to use the functionality by simply holding your card in front of a supporting reader at check out.” – Mark Sullivan, Head of Fraud Risk Programs, Interac Association and Acxsys Corporation

Knocking Out Skimming

Interac debit card fraud losses, as a result of skimming, are at a record low – decreasing 45 per cent to $16.2 million in 2014 from a previous low of $29.5 million in 2013. All ABMs and Interac debit cards have been converted to chip technology – and by the end of 2015, all point-of-sale (POS) terminals will be converted. To date, virtually all cards and ABMs have been converted and 96 per cent of POS terminals.

Not only that, but cardholders are protected from losses through Interac’s Zero Liability Policy.

Fighting Electronic Pickpocketing

And what about pickpockets? I remember playing the ‘Artful Dodger’ in the musical Oliver once. I was much more skilled as a dancer than I was at being a pickpocket, but that was years ago – before the era of electronic pickpocketing. Two out five Canadians (40 per cent) are concerned about electronic pickpocketing. But… when Canadians use Interac Flash, they are safeguarded against counterfeiting and transaction replay types of fraud, including electronic pickpocketing. As a contactless enhancement of Interac Debit, Flash protects cardholders with layers of security, including chip technology and spending limits. No single transaction can be more than $100 and total spend without a PIN can not exceed $200. Once a limit is reached, a cardholder must insert their Interac debit card and enter their PIN for verification, i.e., conduct a regular Interac Debit transaction. The limits are then re-set.

Combatting Retail Data Breaches

Now that we’re talking about nailing criminals and spy stuff, I should discuss retail data breaches. Interac has that covered too. With an Interac debit card, the number on the front is useless to criminals if they don’t have your PIN. Unlike credit cards and other debit card products, Interac rules do not allow the number on the front of the payment card to be used as an account number; it is only an identifier for Interac transactions. This means that any data captured or stolen through skimming or a breach is entirely useless to a criminal because it cannot be used to conduct transactions, online or in person. No personal financial information is ever shared or stored with retailers.

Just don’t forget your pin. And make sure it isn’t the same as the one you were given at age 8.

So what are the bad guys doing now? “Criminals are looking for large amounts of cash and highly fenceable goods, not a few coffees,” reinforced Sullivan. “Interac Flash is about speed and convenience for small value purchases but we know cardholders want security and that’s why it offers strong protections, including protection from criminals attempting electronic pickpocketing to a lost card where someone tries to fraudulently spend $100.”

No more digging in your purse or diaper bag to scrounge for enough change for a coffee. Scotiabank, RBC Royal Bank, and TD Canada Trust are the first financial institutions to offer the enhancement, along with Sunova, Conexus, Cambrian and Affinity Credit Unions. Other Canadian financial institutions are also working to provide their customers with Interac Flash soon.

So maybe it’s time to worry a little less about fraud so you can focus on catching up with your other favourite superheroes.

Disclosure: This post was proudly sponsored by Interac. As always, the opinions shared here are mine, all mine.

The reality is setting in. December has arrived and the holiday to-do list is longer than my children’s wishlist for Santa. (Which is saying something). I haven’t started to shop for gifts, haven’t chosen cookie recipes and my pantry is bare.

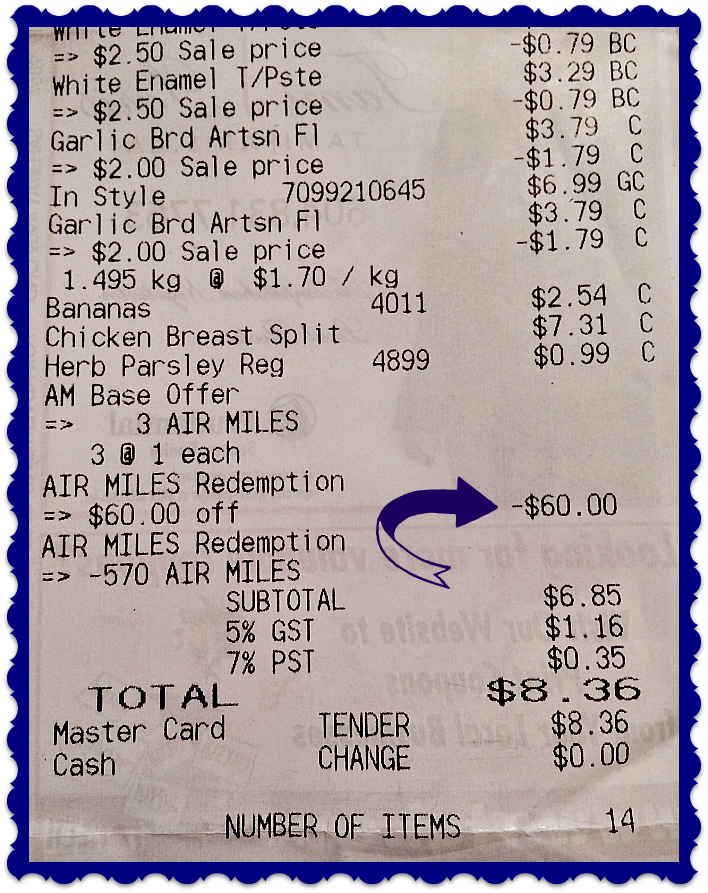

The reality is setting in. December has arrived and the holiday to-do list is longer than my children’s wishlist for Santa. (Which is saying something). I haven’t started to shop for gifts, haven’t chosen cookie recipes and my pantry is bare. I chose from one of my many list-making apps and came up with a cunning plan. Every 95 reward miles redeemed equates to $10 off of the bill at participating stores if you are an AIR MILES Cash Collector, so I will attempt to end up with the smallest credit card bills I’ve ever seen this coming January! My plan:

I chose from one of my many list-making apps and came up with a cunning plan. Every 95 reward miles redeemed equates to $10 off of the bill at participating stores if you are an AIR MILES Cash Collector, so I will attempt to end up with the smallest credit card bills I’ve ever seen this coming January! My plan: