We all want to be healthier, stronger and hit the ideal ratio of body fat to muscle. But since when have we actually been ‘rewarded’ for being healthy? Sure – you feel better within yourself and may get a few more whistles when walking past a construction site, but it is typically pretty challenging to become healthier. Personal trainers are expensive, deep-fried in restaurants seems to cost less, and finding a healthy meal on the go is a challenge. But being healthy has its rewards.

We all want to be healthier, stronger and hit the ideal ratio of body fat to muscle. But since when have we actually been ‘rewarded’ for being healthy? Sure – you feel better within yourself and may get a few more whistles when walking past a construction site, but it is typically pretty challenging to become healthier. Personal trainers are expensive, deep-fried in restaurants seems to cost less, and finding a healthy meal on the go is a challenge. But being healthy has its rewards.

As many of our readers know, I have been training for a Run Disney event. Not having run more than a few feet and only when necessary (like being chased by a rabid dog), this was a huge challenge for me. Sure it was personally rewarding when I completed the run, but it took so much mental strength to force myself to train and be healthier. Perhaps I shouldn’t need a reward other than feeling good or personal satisfaction, but….

As many of our readers know, I have been training for a Run Disney event. Not having run more than a few feet and only when necessary (like being chased by a rabid dog), this was a huge challenge for me. Sure it was personally rewarding when I completed the run, but it took so much mental strength to force myself to train and be healthier. Perhaps I shouldn’t need a reward other than feeling good or personal satisfaction, but….

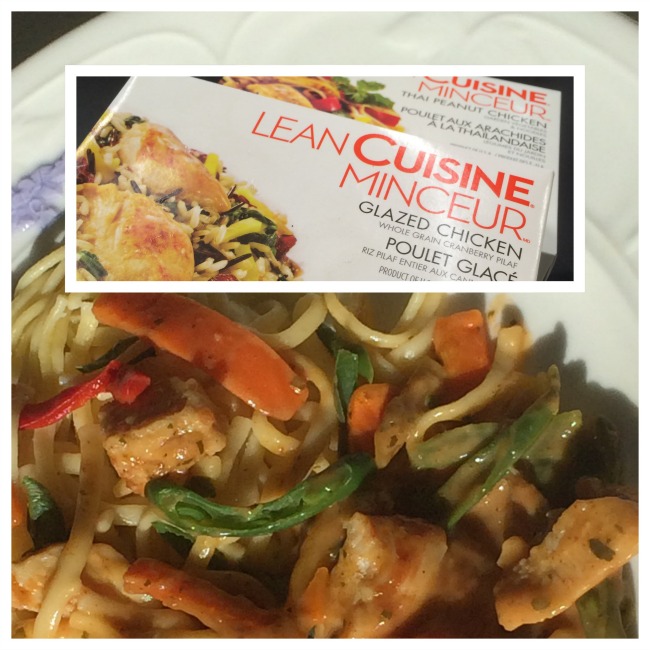

Part of becoming healthier has been my diet, and as a busy entrepreneur and Mom, washing lettuce leaves and chopping veggies is not always in the cards. I’ve always loved to stock my freezer with Lean Cuisine meals so I have something well balanced, filling and healthy when I need to eat in a hurry. Only now have I discovered that I can get rewarded for pulling this healthy trick out of my back pocket.

The Lean Cuisine Rewards program allows you to pop onto the internet and enter a PIN number found inside your favourite Lean Cuisine meal. The more you enjoy, the more you earn. Rewards range from coupons for free Lean Cuisine entrées to exercise balls, weights and home appliances.

The Lean Cuisine Rewards program allows you to pop onto the internet and enter a PIN number found inside your favourite Lean Cuisine meal. The more you enjoy, the more you earn. Rewards range from coupons for free Lean Cuisine entrées to exercise balls, weights and home appliances.

Embarking on this new way to feel rewarded, I pulled a Thai Peanut Chicken out of the freezer. (This is where I admit that I didn’t eat breakfast and ate it at 9am after dropping the kids to school.) After four and a half minutes in the microwave, the veggies were still crisp and the chicken was tender. There seemed to be a ton of chicken for a meal that only has 300 calories, 6g of fat and 40% of my daily vitamin A. I was delighted. And energized. I think I may actually go for a run! Ha!

Excited to check out my rewards, I went to the Lean Cuisine website and registered. There are healthy lifestyle tips, a rewards catalogue and you can also create a meal and exercise plan in order to reach specific goals. I, of course, got sidetracked by the rewards and made a wishlist: a Spafinder gift certificate, iTunes music credits, Best Health Magazine and a Hamilton Beach blender. Not that personal satisfaction isn’t enough (ahem) but that makes me want to get healthy.

How do you reward yourself? We can help out a bit – want to enter to win a free Lean Cuisine BONUS PIN code (good for one entrée or to start you off for larger rewards)? Just use this handy rafflecopter form. Canada only, ends 30. May, 2014. Good luck!

Disclosure: This post was generously sponsored by Stouffers Lean Cuisine Rewards, but the opinions and images are my own. For more information, visit Lean Cuisine Rewards.